Organizational Profile

- Appropriate minister:

- The Honourable Lawrence MacAulay, PC, MP

- Institutional head:

- General (retired) Walter Natynczyk, CMM, MSC, CD,

Deputy Minister (for 2020–21) - Paul Ledwell, Deputy Minister (as of May 2021)

- Ministerial portfolio:

- Veterans Affairs

- Enabling instruments:

- Department of Veterans Affairs Act

- Veterans Well-being ActFootnote 20

- Pension Act

- Year of incorporation / commencement:

- 1923

Our Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role” is available on our website.

Veterans Ombud’s Mandate

The mandate for the Veterans Ombud is available on the Ombud’s website.

Operating context

Information on operating context is available on our website.

Reporting framework

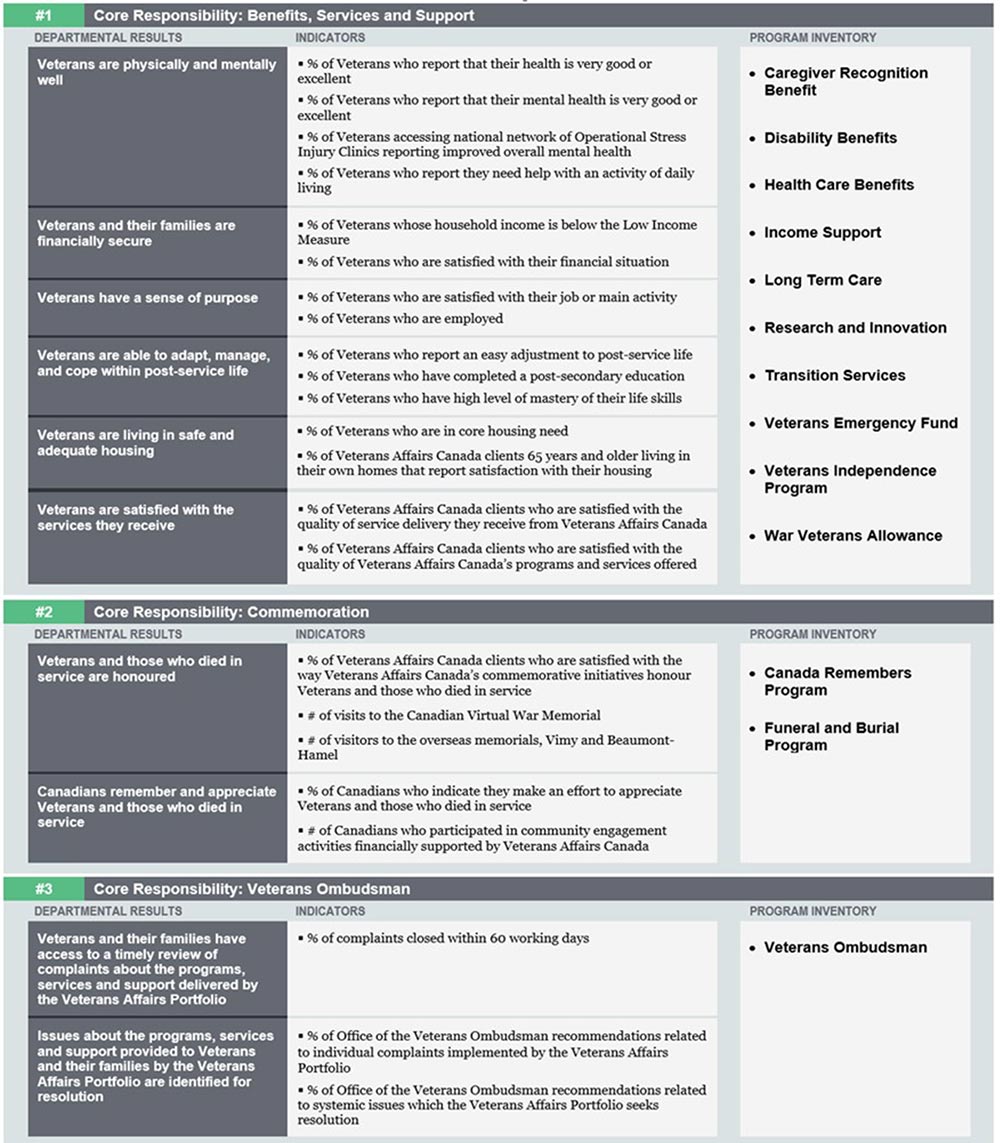

Shown below is a diagram of our DRF and Program Inventory of record for 2020–21:

Core Responsibility: Benefits, Services and Support

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans are physically and mentally well |

|

|

| Veterans and their facilities are financially secure |

|

|

| Veterans have a sense of purpose |

|

|

| Veterans are able to adapt, manage, and cope within post-service life |

|

|

| Veterans are living in safe and adequate housing |

|

|

| Veterans are satisfied with the services they receive |

|

Core Responsibility: Commemoration

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans and those who died in service are honoured |

|

|

| Canadians remember and appreciate Veterans and those who died in service |

|

Core Responsibility: Veterans Ombudsman

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans and their families have access to a timely review of complaints about the programs, services and support delivered by the Veterans Affairs Portfolio |

|

|

| Issues about the programs, services and support provided to Veterans and their families by the Veterans Affairs Portfolio are identified and addressed |

|

Supporting information on the Program Inventory

Financial, human resources and performance information for our Program Inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on our website.

- Departmental Sustainable Development Strategy

- Details on transfer payment programs of $5 million or more

- Gender-based analysis plus

- Response to parliamentary committees and external audits

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures.This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs, as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Veterans Affairs Canada

161 Grafton Street

P.O. Box 7700

Charlottetown PE C1A 8M9

Toll free: 1-866-522-2122

www.veterans.gc.ca

Veterans Ombud

134 Kent Street

P.O. Box 66

Charlottetown PE C1A 7K2

Toll free: 1-877-330-4343

www.ombudsman-veterans.gc.ca