April - June 2018

Table of Contents

-

I. Statement outlining results, risks and significant changes in operations, personnel and program for the quarter ended June 30, 2018

-

II. Financial Statements

I. Statement outlining results, risks and significant changes in operations, personnel and program for the quarter ended June 30, 2018

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates as well as Economic Action Plan 2017 and 2018 (Budget 2017 and Budget 2018).

A summary description of Veterans Affairs Canada's (VAC) program activities can be found in Part II of the Main Estimates.

Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities includes VAC's spending authorities granted by Parliament and those used by the Department, consistent with the Main Estimates for the 2018-19 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

The quarterly report has not been subject to an external audit but has been reviewed by the Departmental Audit Committee.

2. Highlights of Fiscal Quarter and Fiscal Year to-Date (YTD) Results

Statement of Authorities

Overall, VAC's authorities reflect the changing demographic profile and changing needs of the men, women, and families the Department serves. This is evidenced by an increase in the number of modern-day Veterans and survivors (forecast to increase from 107,078 as of March 31, 2018, to 112,900 as of March 31, 2019) and a decrease in the number of War Service Veterans and survivors (forecast to decrease from 67,648 as of March 31, 2018, to 60,000 as of March 31, 2019). Despite the slight decrease in overall Veterans and recipients of VAC benefits, recent program enhancements have increased the demand on New Veterans Charter programs and benefits.

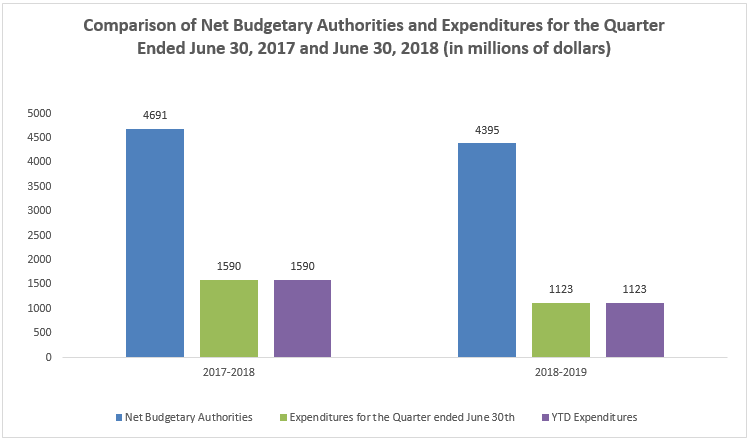

As at June 30, 2018, total authorities available (i.e. budget) for the year have decreased by $296M (6.3%) compared to the same quarter of the previous year, from $4,691M to $4,395M. This decrease is the result of a $401M decrease in Vote 5, Grants and Contributions and a $105M increase in Vote 1, Operating Expenditures. These authorities reflect an annual adjustment based on updated client participation and program expenditures.

Total authorities used (i.e. expenditures) during the first quarter of 2018-19 are $467M (29.4%) less when compared to the same three-month period of 2017-18, from $1,590M to $1,123M. A break-down in the spending for the first quarter of 2018-19 indicates that Grant and Contribution spending decreased by $470M, primarily due to the Budget 2016 commitment to increase the Disability Award (maximum increased to $360,000 effective April 1, 2017), resulting in one-time top-up payments to all Veterans who received a Disability Award since April 1, 2006. These additional expenditures impacted the first quarter of 2017-18. Additionally, spending on Operating expenditures (Vote 1) increased slightly by approximately $2M, and spending on statutory authorities remained relatively stable with only a small increase of approximately $68K.

Figure 1 - First Quarter and Year-to-date Expenditures Compared to Budget

| Fiscal Years | 2017-2018 | 2018-2019 |

|---|---|---|

| Net Budgetary Authorities | 4,691 | 4,395 |

| Expenditures for the Quarter ended June 30th | 1,590 | 1,123 |

| Year to date Expenditures | 1,590 | 1,123 |

As a result of the Government's expenditure management cycle, there are often fluctuations by quarter and between fiscal years when comparing budgets and expenditures. This is primarily a result of the quasi-statutory nature of the Department's programs, which are demand-driven and based on need and entitlement. In other words, Veterans who meet the eligibility criteria for VAC's programs are paid as they apply for benefits.

Statement of Departmental Budgetary Expenditures by Standard Object

When analyzed by Standard Object, expenditures in the first quarter are generally consistent in comparison with prior-year spending. The largest variances include:

- A decrease of $470M in Transfer Payments which, as noted above, relates primarily to the Budget 2016 commitment to increase the Disability Award (maximum increased to $360,000 effective April 1, 2017), resulting in one-time top-up payments to all Veterans who received a Disability Award since April 1, 2006. These additional expenditures impacted the first quarter of 2017-18.

- An increase of $1.5M in Personnel services primarily attributed to reopening offices and an increase in case management services.

- A decrease of $3.8M in Professional and Special Services primarily attributed to an increase in expenditures in the first quarter of 2017-18 for overseas events to mark the 100th anniversary of Vimy Ridge.

3. Risks and Uncertainties

VAC is dedicated to enhancing the health and well-being of Veterans and their families and recognizes that its success in fulfilling this mandate is directly related to the effective management of risk. Sound risk management equips the Department to respond proactively to change and uncertainty by using risk-based information to support effective decision-making, resource allocation, and, ultimately, better results for Canadians. Additionally, it can lead to effective service delivery, better project management, and an increase in value for money.

VAC operates in a dynamic and complex environment characterized by internal and external drivers of change. The Department employs integrated risk management tools to proactively and systematically recognize, understand, accommodate and capitalize on new challenges and opportunities, with a focus on results. In addition, the Department has effective internal control systems in place, proportionate to the risks being managed.

VAC continues to manage through effective engagement across the Department. As such, the Department's executive-level committee (Senior Management Committee) recommends overall direction for financial management and control, and the Corporate Policy and Planning Management Committee ensures alignment of investments with departmental strategies and other initiatives. Each branch is required to have an Integrated Business Plan that has been approved by the Senior Management Committee to confirm that it has a plan in place to address the financial requirements of the branch. The Department captures program and corporate level risk in the Integrated Business Plans, including several key risks: delays in achieving the required staffing levels may delay implementation of some Departmental commitments; despite the broad range of Veterans' programs and services available, some CAF members may not transition successfully from military to civilian life; and the department may have difficulty addressing the volume of commitments made to Veterans in a timely manner. Risk response strategies are established to lessen any impact should such risks occur. The Department monitors these risks through the Departmental Results Framework and internal performance reports. Tracking our performance in these areas allows us to make timely adjustments and ensure risks are being effectively mitigated.

Additionally, the Deputy Minister's Advisory Committee (DMAC) provides an advisory function for senior departmental officials as well as performing an important oversight role in ensuring that budget commitments are met. DMAC was established, in the context of Budget 2015 decisions to improve service delivery, to support VAC and the Department of National Defence (DND) in advancing a “Veteran-centric” approach to the protection and care of Veterans.

This integrated risk management process ultimately supports the Department in meeting its financial objectives. Further information on risks facing the Department and the steps taken to mitigate them can be found in the 2018-19 Departmental Plan.

4. Significant Changes in Relation to Operations, Personnel and Programs

Mandate Commitments:

April 1, 2018, marked an important milestone for delivering on eight mandate commitments that will improve supports for Veterans and their families. This comprehensive package recognizes the hard work and sacrifices of Veterans through new and enhanced programs and services that provide direct support to caregivers, helps more families, supports mental health and offers greater education and training benefits that Veterans may need in their post-service lives. The six new programs and services announced in Budget 2017 are listed below:

- Education and Training Benefit

- Career Transition Services Program

- Caregiver Recognition Benefit

- Veterans Emergency Fund

- Centre of Excellence on Post-Traumatic Stress Disorder and other related mental health conditions

- Veteran and Family Well-Being Fund

Two enhanced programs and services were also announced in Budget 2017:

- Extending access to the DND-CAF's Military Family Services Program to medically-releasing members.

- Removal of Time Limits – Rehabilitation Services and Vocational Assistance Program.

5. Approvals by Senior Officials

Original signed by:

__________________________________

W.J. Natynczyk

General (Retired)

Deputy Minister

Ottawa, ON

August 21, 2018

__________________________________

Elizabeth M. Stuart

Rear-Admiral (Retired)

Chief Financial Officer

Charlottetown, PE

August 14, 2018

II. Financial Statements

Statement of Authorities (unaudited)

| (in thousands of dollars) | Total available for use for the year ended March 31, 2018* | Used during the quarter ended June 30, 2017 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net Operating expenditures | 931,959 | 201,374 | 201,374 |

| Vote 5 - Grants and Contributions | 3,728,239 | 1,381,360 | 1,381,360 |

| Statutory Authority - Minister's Salary and Motor Car Allowance | 84 | 21 | 21 |

| Statutory Authority - Court Award - Crown Liability and Proceeding Act | 0 | 5 | 5 |

| Statutory Authority - Refunds of Previous Years Revenue | 0 | 1 | 1 |

| Statutory Authority - Contributions to Employee Benefit Plans - Program | 30,920 | 7,730 | 7,730 |

| Statutory Authority - Veterans Insurance Actuarial Liability Adjustment | 175 | 0 | 0 |

| Statutory Authority - Returned Soldiers Insurance Actuarial Liability Adjustment | 10 | 0 | 0 |

| Statutory Authority - Re-establishment credits under Section 8 of the War Services Grants Act | 2 | 0 | 0 |

| Statutory Authority - Repayments under Section 15 of the War Services Grants Act | 10 | 0 | 0 |

| Total Statutory | 31,201 | 7,757 | 7,757 |

| Total Budgetary authorities | 4,691,399 | 1,590,491 | 1,590,491 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total Authorities | 4,691,399 | 1,590,491 | 1,590,491 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

| (in thousands of dollars) | Total available for use for the year ending March 31, 2019* | Used during the quarter ended June 30, 2018 | Year-to-date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net Operating expenditures | 1,036,045 | 204,375 | 204,375 |

| Vote 5 - Grants and Contributions | 3,327,017 | 911,133 | 911,133 |

| Statutory Authority - Minister's Salary and Motor Car Allowance | 86 | 22 | 22 |

| Statutory Authority - Court Award - Crown Liability and Proceeding Act | 0 | 0 | 0 |

| Statutory Authority - Refunds of Previous Years Revenue | 0 | 0 | 0 |

| Statutory Authority - Contributions to Employee Benefit Plans - Program | 31,210 | 7,803 | 7,803 |

| Statutory Authority - Veterans Insurance Actuarial Liability Adjustment | 175 | 0 | 0 |

| Statutory Authority - Returned Soldiers Insurance Actuarial Liability Adjustment | 10 | 0 | 0 |

| Statutory Authority - Re-establishment credits under Section 8 of the War Services Grants Act | 2 | 0 | 0 |

| Statutory Authority - Repayments under Section 15 of the War Services Grants Act | 10 | 0 | 0 |

| Total Statutory | 31,493 | 7,825 | 7,825 |

| Total Budgetary authorities | 4,394,555 | 1,123,333 | 1,123,333 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total Authorities | 4,394,555 | 1,123,333 | 1,123,333 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental budgetary expenditures by Standard Object (unaudited)

| Expenditures (in thousands of dollars) | Planned expenditures for the year ended March 31, 2018 | Expended during the quarter ended June 30, 2017 | Year-to-date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 227,949 | 58,678 | 58,678 |

| 02 Transportation and communications | 29,768 | 6,594 | 6,594 |

| 03 Information | 6,248 | 46 | 46 |

| 04 Professional and special services | 457,547 | 87,105 | 87,105 |

| 05 Rentals | 8,085 | 1,151 | 1,151 |

| 06 Repair and maintenance | 11,025 | 536 | 536 |

| 07 Utilities, materials and supplies | 213,154 | 49,726 | 49,726 |

| 08 Acquisition of land, buildings and works | 735 | 0 | 0 |

| 09 Acquisition of machinery and equipment | 2,572 | 195 | 195 |

| 10 Transfer payments | 3,728,436 | 1,381,360 | 1,381,360 |

| 11 Public debt charges | 0 | 0 | 0 |

| 12 Other subsidies and payments | 5,880 | 5,100 | 5,100 |

| Total gross budgetary expenditures | 4,691,399 | 1,590,491 | 1,590,491 |

| Less Revenues netted against expenditures | 0 | 0 | 0 |

| Total Revenues netted against expenditures: | 0 | 0 | 0 |

| Total net budgetary expenditures | 4,691,399 | 1,590,491 | 1,590,491 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

| Expenditures (in thousands of dollars) | Planned expenditures for the year ending March 31, 2019 | Expended during the quarter ended June 30, 2018 | Year-to-date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 236,624 | 60,138 | 60,138 |

| 02 Transportation and communications | 36,207 | 7,435 | 7,435 |

| 03 Information | 4,157 | 264 | 264 |

| 04 Professional and special services | 508,436 | 83,265 | 83,265 |

| 05 Rentals | 8,807 | 864 | 864 |

| 06 Repair and maintenance | 10,513 | 511 | 511 |

| 07 Utilities, materials and supplies | 256,283 | 50,575 | 50,575 |

| 08 Acquisition of land, buildings and works | 528 | 0 | 0 |

| 09 Acquisition of machinery and equipment | 1,520 | 313 | 313 |

| 10 Transfer payments | 3,327,214 | 911,133 | 911,133 |

| 11 Public debt charges | 0 | 0 | 0 |

| 12 Other subsidies and payments | 4,266 | 8,835 | 8,835 |

| Total gross budgetary expenditures | 4,394,555 | 1,123,333 | 1,123,333 |

| Less Revenues netted against expenditures | 0 | 0 | 0 |

| Total Revenues netted against expenditures: | 0 | 0 | 0 |

| Total net budgetary expenditures | 4,394,555 | 1,123,333 | 1,123,333 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.