October - December 2016

Table of Contents

-

I. Statement outlining results, risks and significant changes in operations, personnel and program for the quarter ended December 31, 2016

-

II. Financial Statements

I. Statement outlining results, risks and significant changes in operations, personnel and program for the quarter ended December 31, 2016

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main and Supplementary Estimates as well as Economic Action Plan 2015 and 2016 (Budget 2015 and Budget 2016).

A summary description of Veterans Affairs Canada’s (VAC) program activities can be found in Part II of the Main Estimates.

Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities includes VAC’s spending authorities granted by Parliament and those used by the Department, consistent with the Main and Supplementary Estimates for the 2016–17 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, VAC prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis.

The quarterly report has not been subject to an external audit but has been reviewed by the Departmental Audit Committee.

2. Highlights of Fiscal Quarter and Fiscal Year to-Date (YTD) Results

Statement of Authorities

Overall, VAC’s authorities reflect the changing demographic profile and changing needs of the men, women, and families the Department serves. This is evidenced by an increase in the number of modern-day Veterans and survivors (forecast to increase from 97,558 in 2015–16 to 102,400 in 2016–17) accessing programs under the New Veterans Charter and a decrease in the number of War Service Veterans and survivors (forecast to decrease from 85,111 in 2015–16 to 76,000 in 2016–17) accessing the Department's traditional programs. Despite the slight decrease in overall Veterans and recipients of VAC benefits, recent program enhancements have increased the demand on New Veterans Charter programs and benefits.

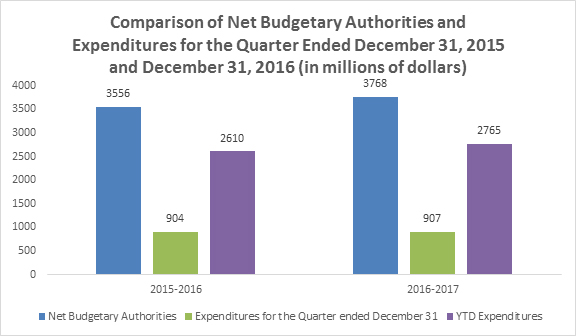

As at December 31, 2016, total authorities available (i.e. budget) for the year have increased by $212M (5.9%) compared to the same quarter of the previous year, from $3,556M to $3,768M. This increase is the result of a $137M increase in Vote 5, Grants and Contributions, a $69M increase in Vote 1, Operating Expenditures, and a $6M increase in statutory authorities related to employee benefit costs.

Total authorities used (i.e. expenditures) during the third quarter of 2016–17 are $3M (0.3%) more when compared to the same three-month period of 2015–16, from $904M to $907M. A break-down in the spending for the third quarter of 2016–17 indicates that Operating expenditures increased by $29M, and statutory authorities increased by $1M. This is offset by Grant and Contribution spending decreasing by $27M due to decreased requirements for War Service Veterans and Survivors, as well as the timing of payments for Disability Awards which, while decreasing this quarter, have increased from a year-to-date perspective.

Figure 1 - Third Quarter and Year-to-date Expenditures Compared to Budget

Figure 1 - Third Quarter and Year-to-date Expenditures Compared to Budget

| Fiscal Year | Net Budgetary Authorities | Expenditures for the Quarter ended December 31 | YTD Expenditures |

|---|---|---|---|

| 2015-2016 | 3556 | 904 | 2610 |

| 2016-2017 | 3768 | 907 | 2765 |

As a result of the Government’s expenditure management cycle, the fluctuations by quarter and between fiscal years (when comparing budgets and expenditures) are primarily a result of the quasi-statutory nature of the Department’s programs; which are demand-driven and based on need and entitlement. In other words, Veterans who meet the eligibility criteria for VAC’s programs are paid as they apply for benefits.

Statement of Departmental Budgetary Expenditures by Standard Object

When analyzed by Standard Object, expenditures in the third quarter are generally consistent in comparison with prior-year spending. The largest variances include:

- An increase of $27M in Professional and Special Services and $5M in Utilities, Materials and Supplies which relates primarily to an increase in requirements for health services for Veterans, such as prescription drugs and long-term care.

- A decrease of $27M in Transfer Payments which relates primarily to a decrease in Disability Pensions expenditures (due to a decrease in the number of War Service Veterans and Survivors) and Disability Award expenditures (due to the timing of payments, as Disability Award expenditures have increased from a year-to-date perspective). These decreases are partially offset by increased requirements for Earnings Loss and Supplementary Retirement Benefits.

- A decrease of $4M in Personnel services resulting from the transfer of Ste. Anne’s Hospital to the Province of Quebec on April 1, 2016. This decrease is partially offset by increased staffing for case management and the disability benefit program to support recent program enhancements and demand.

3. Risks and Uncertainties

VAC is dedicated to enhancing the health and well-being of Veterans and their families and recognizes that its success in fulfilling this mandate is directly related to the effective management of risk. Sound risk management equips the Department to respond proactively to change and uncertainty by using risk-based information to support effective decision-making, resource allocation, and, ultimately, better results for Canadians. Additionally, it can lead to effective service delivery, better project management, and an increase in value for money.

VAC operates in a dynamic and complex environment characterized by internal and external drivers of change. The Department employs integrated risk management tools to proactively and systematically recognize, understand, accommodate and capitalize on new challenges and opportunities, with a focus on results. In addition, the Department has effective internal control systems in place, proportionate to the risks being managed.

VAC continues to manage through effective engagement across the Department. As such, the Department’s executive-level committee (Senior Management Committee) recommends overall direction for financial management and control, and the Corporate Management Committee ensures alignment of investments with departmental strategies and other initiatives. Each branch is required to have an Integrated Business Plan that has been approved by the Senior Management Committee to confirm that it has a plan in place to address the financial requirements of the branch. The Department captures program and corporate level risk in the Integrated Business Plans, including several key risks: delays in achieving the required staffing levels may delay implementation of some Departmental commitments; despite the broad range of Veterans’ programs and services available, some CAF members may not transition successfully from military to civilian life; and the department may have difficulty addressing the volume of commitments made to Veterans in a timely manner. Risk response strategies are established to lessen any impact should such risks occur.

Additionally, the Deputy Minister’s Advisory Committee (DMAC) provides an advisory function for senior departmental officials as well as performing an important oversight role in ensuring that Budget 2015 and Budget 2016 commitments are met. DMAC was established, in the context of Budget 2015 decisions to improve service delivery, to support VAC and the Department of National Defence (DND) in advancing a “Veteran-centric” approach to the protection and care of Veterans.

This integrated risk management process ultimately supports the Department in meeting its financial objectives. Further information on risks facing the Department and the steps taken to mitigate them can be found in the 2016–17 Report on Plans and Priorities.

4. Significant Changes in Relation to Operations, Personnel and Programs

There were no changes at the senior management level during the third quarter of this fiscal year.

Mandate Commitments:

During the third quarter of 2016–17, VAC offices were reopened in Brandon, MB; Sydney, NS; Kelowna, BC; Saskatoon, SK; and Charlottetown, PE. Offices to reopen in 2017 include Thunder Bay, ON; Windsor, ON; and Prince George, BC. An office will also open in Surrey, BC.

Effective October 1, 2016, the Earnings Loss Benefit has been increased to 90% of a Veteran’s pre-release salary to ensure former members undergoing rehabilitation have the financial support they need.

Also effective October 1, 2016, the Department increased the estate exemption for the Funeral and Burial Program from $12,015 to $35,279 and will also apply an annual cost of living adjustment to this amount. This will make it easier for Veterans’ families to access the Funeral and Burial Program for a dignified burial.

Commemorative Activities:

On November 17, 2016, the Honourable Kent Hehr, Minister of Veterans Affairs and Associate Minister of National Defence, announced that the Government of Canada plans to commemorate the 100th anniversary of the Battle of Vimy Ridge and the First World War in France and Canada in April 2017. Official commemorative ceremonies will take place at the Canadian National Vimy Memorial in France, the National War Memorial in Ottawa and in major cities across Canada on April 9, 2017.

Program Changes:

On November 22, 2016, the Minister announced a new reimbursement policy on cannabis for medical purposes. The new policy establishes a reimbursement limit of three grams per day of cannabis for medical purposes sold by licensed producers or the equivalent value in fresh marijuana or cannabis oil. To inform the new reimbursement policy, Veterans Affairs Canada conducted a review of the guidelines and procedures relating to the reimbursement of cannabis. The Department consulted with Veterans, stakeholders, medical experts and licensed producers.

Additionally, and consistent with how the Department administers its other health care benefits, a rate of up to $8.50 per gram has been established. The rate will ensure that what Veterans are charged, and the Department reimburses, is a fair market value.

Understanding that the transition can be challenging, Veterans being reimbursed for more than three grams per day will have until May 21, 2017 at their current amount if authorized by their health care practitioner. There will also be an exceptional circumstances process for Veterans authorized for more than three grams per day. The Cannabis for Medical Purposes reimbursement policy balances anecdotal evidence from Veterans and stakeholders with current available evidence. The health and well-being of Veterans is at the forefront of this new approach.

5. Approvals by Senior Officials

Original signed by:

________________________________________

W.J. Natynczyk, General (Retired)

Deputy Minister

Ottawa, ON

February 22, 2017

________________________________________

Elizabeth M. Stuart

Rear-Admiral (Retired)

Chief Financial Officer

Charlottetown, PE

February 21, 2017

II. Financial Statements

Statement of Authorities (unaudited)

| (in thousands of dollars) | Total available for use for the year ending March 31, 2016* |

Used during the quarter ended December 31, 2015 |

Year to date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net Operating expenditures | 873,423 | 208,067 | 579,955 |

| Vote 5 - Grants and Contributions | 2,655,148 | 689,339 | 2,009,383 |

| Statutory Authority - Minister's Salary and Motor Car Allowance | 82 | 14 | 55 |

| Statutory Authority – Court Award – Crown Liability and Proceeding Act | 0 | 2 | 12 |

| Statutory Authority – Refunds of Previous Years Revenue | 0 | 0 | 17 |

| Statutory Authority – Spending of Amounts Equivalent to Proceeds from Disposal of Surplus Moveable Crown Assets | 0 | 1 | 16 |

| Statutory Authority – Contributions to Employee Benefit Plans – Program | 27,363 | 6,762 | 20,286 |

| Statutory Authority – Veterans Insurance Actuarial Liability Adjustment | 175 | 0 | 0 |

| Statutory Authority – Returned Soldiers Insurance Actuarial Liability Adjustment | 10 | 0 | 0 |

| Statutory Authority – Re-establishment credits under Section 8 of the War Services Grants Act | 2 | 0 | 0 |

| Statutory Authority – Repayments under Section 15 of the War Services Grants Act | 10 | 0 | 0 |

| Total Statutory | 27,642 | 6,779 | 20,386 |

| Total Budgetary Authorities | 3,556,213 | 904,185 | 2,609,724 |

| Non-Budgetary Authorities | 0 | 0 | 0 |

| Total Authorities | 3,556,213 | 904,185 | 2,609,724 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

| (in thousands of dollars) | Total available for use for the year ended March 31, 2017* |

Used during the quarter ended December 31, 2016 |

Year to date used at quarter-end |

|---|---|---|---|

| Vote 1 - Net Operating expenditures | 942,010 | 236,745 | 676,000 |

| Vote 5 - Grants and Contributions | 2,792,062 | 662,197 | 2,064,606 |

| Statutory Authority - Minister's Salary and Motor Car Allowance | 84 | 21 | 63 |

| Statutory Authority – Court Award – Crown Liability and Proceeding Act | 0 | 4 | 7 |

| Statutory Authority – Refunds of Previous Years Revenue | 0 | 0 | 32 |

| Statutory Authority – Spending of Amounts Equivalent to Proceeds from Disposal of Surplus Moveable Crown Assets | 0 | 0 | 6 |

| Statutory Authority – Contributions to Employee Benefit Plans – Program | 33,371 | 7,973 | 23,918 |

| Statutory Authority – Veterans Insurance Actuarial Liability Adjustment | 175 | 0 | 0 |

| Statutory Authority – Returned Soldiers Insurance Actuarial Liability Adjustment | 10 | 0 | 0 |

| Statutory Authority – Re-establishment credits under Section 8 of the War Services Grants Act | 2 | 0 | 0 |

| Statutory Authority – Repayments under Section 15 of the War Services Grants Act | 10 | 0 | 0 |

| Total Statutory | 33,652 | 7,998 | 24,026 |

| Total Budgetary Authorities | 3,767,724 | 906,940 | 2,764,632 |

| Non-Budgetary Authorities | 0 | 0 | 0 |

| Total Authorities | 3,767,724 | 906,940 | 2,764,632 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental Budgetary Expenditures by Standard Object (unaudited)

| Expenditures (in thousands of dollars) |

Planned expenditures for the year ending March 31, 2016 |

Expended during the quarter ended December 31, 2015 |

Year to date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 260,268 | 64,558 | 187,475 |

| 02 Transportation and communications | 29,012 | 7,172 | 18,167 |

| 03 Information | 5,583 | 1,708 | 1,957 |

| 04 Professional and special services | 393,526 | 81,322 | 261,251 |

| 05 Rentals | 7,226 | 2,200 | 4,329 |

| 06 Repair and maintenance | 7,882 | 1,375 | 2,541 |

| 07 Utilities, materials and supplies | 183,861 | 55,193 | 115,434 |

| 08 Acquisition of land, buildings and works | 1,971 | 210 | 210 |

| 09 Acquisition of machinery and equipment | 3,284 | 265 | 1,058 |

| 10 Transfer payments | 2,655,345 | 689,339 | 2,009,383 |

| 11 Public debt charges | 0 | 0 | 0 |

| 12 Other subsidies and payments | 8,255 | 843 | 7,919 |

| Total gross budgetary expenditures | 3,556,213 | 904,185 | 2,609,724 |

| Less revenues netted against expenditures | 0 | 0 | 0 |

| Total revenues netted against expenditures | 0 | 0 | 0 |

| Total net budgetary expenditures | 3,556,213 | 904,185 | 2,609,724 |

| Expenditures (in thousands of dollars) |

Planned expenditures for the year ending March 31, 2017 |

Expended during the quarter ended December 31, 2016 |

Year to date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 250,701 | 60,209 | 210,236 |

| 02 Transportation and communications | 30,726 | 7,779 | 20,592 |

| 03 Information | 5,687 | 1,044 | 1,245 |

| 04 Professional and special services | 440,732 | 108,132 | 290,394 |

| 05 Rentals | 11,228 | 1,483 | 3,632 |

| 06 Repair and maintenance | 6,758 | 2,950 | 7,058 |

| 07 Utilities, materials and supplies | 196,063 | 59,705 | 155,637 |

| 08 Acquisition of land, buildings and works | 1,652 | 3 | 1,050 |

| 09 Acquisition of machinery and equipment | 2,980 | 515 | 1,164 |

| 10 Transfer payments | 2,792,259 | 662,197 | 2,064,606 |

| 11 Public debt charges | 0 | 0 | 0 |

| 12 Other subsidies and payments | 28,938 | 2,923 | 9,018 |

| Total gross budgetary expenditures | 3,767,724 | 906,940 | 2,764,632 |

| Less revenues netted against expenditures | 0 | 0 | 0 |

| Total revenues netted against expenditures | 0 | 0 | 0 |

| Total net budgetary expenditures | 3,767,724 | 906,940 | 2,764,632 |