Corporate information

Organizational profile

- Appropriate minister:

- The Honourable Seamus O'Regan, P.C., M.P.

- Institutional head:

- General (retired) Walter Natynczyk, C.M.M., M.S.C., C.D.,

Deputy Minister - Ministerial portfolio:

- Veterans Affairs

- Enabling instruments:

- Department of Veterans Affairs Act

- Canadian Forces Members and Veterans Re-establishment and Compensation Act (The New Veterans Charter)Footnote 7

- Pension Act

- Year of incorporation / commencement:

- 1923

Reporting framework

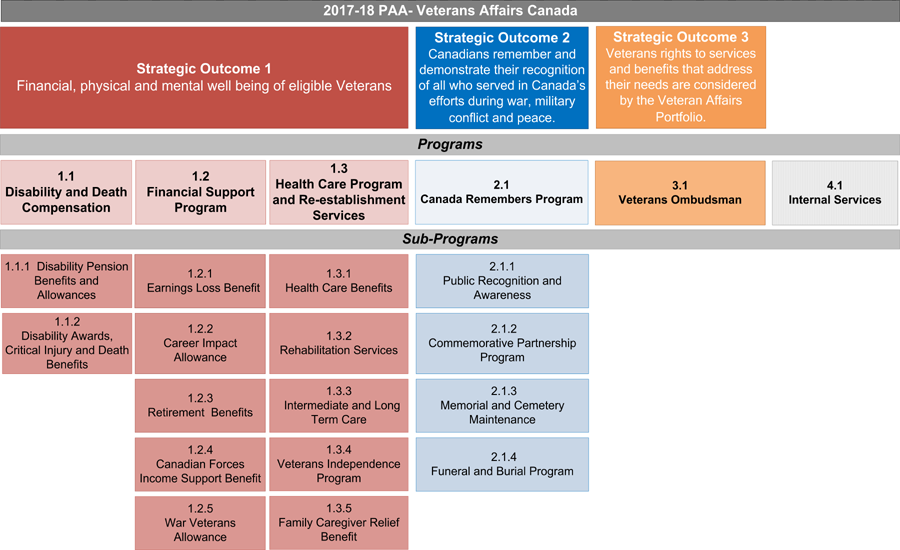

Veterans Affairs Canada's Strategic Outcomes and Program Alignment Architecture of record for 2017–18 are shown below.

2017–18 PAA - Veterans Affairs Canada

- Strategic Outcome 1: Financial, physical, and mental well-being of eligible Veterans

- 1.1 Program: Disability and Death Compensation

- 1.1.1 Sub-Program: Disability Pension Benefits and Allowances

- 1.1.2 Sub-Program: Disability Awards, Critical Injury and Death Benefits

- 1.2 Program: Financial Support Program

- 1.2.1 Sub-Program: Earnings Loss Benefit

- 1.2.2 Sub-Program: Career Impact Allowance

- 1.2.3 Sub-Program: Retirement Benefits

- 1.2.4 Sub-Program: Canadian Forces Income Support Benefit

- 1.2.5 Sub-Program: War Veterans Allowance

- 1.3 Program: Health Care Program and Re-establishment Services

- 1.3.1 Sub-Program: Health Care Benefits

- 1.3.2 Sub-Program: Rehabilitation Services

- 1.3.3 Sub-Program: Intermediate and Long Term Care

- 1.3.4 Sub-Program: Veterans Independence Program

- 1.3.5 Sub-Program: Family Caregiver Relief Benefit

- 1.1 Program: Disability and Death Compensation

- Strategic Outcome 2: Canadians remember and demonstrate their recognition of all who served in Canada's efforts during war, military conflict, and peace

- 2.1 Program: Canada Remembers Program

- 2.1.1 Sub-Program: Public Recognition and Awareness

- 2.1.2 Sub-Program: Commemorative Partnership Program

- 2.1.3 Sub-Program: Memorial and Cemetery Maintenance

- 2.1.4 Sub-Program: Funeral and Burial Program

- 2.1 Program: Canada Remembers Program

- Strategic Outcome 3: Veterans rights to services and benefits that address their needs are considered by the Veterans Affairs Portfolio

- 3.1 Program: Veterans Ombudsman

- 4.1 Program: Internal Services

Supporting information on lower-level programs

Supporting information on lower level programs is available on the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on VAC's website

- Departmental Sustainable Development Strategy;

- Details on transfer payment programs of $5 million or more;

- Internal audits;

- Evaluations;

- Fees; and

- Response to parliamentary committees and external audits

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Veterans Affairs Canada

161 Grafton Street

P.O. Box 7700

Charlottetown PE C1A 8M9

Toll free: 1-866-522-2122

www.veterans.gc.ca

Veterans Ombudsman

134 Kent Street

P.O. Box 66

Charlottetown PE C1A 7K2

Toll free: 1-877-330-4343

www.ombudsman-veterans.gc.ca