Organizational profile

- Appropriate minister:

- The Honourable Lawrence MacAulay, PC, MP

- Institutional head:

- General (retired) Walter Natynczyk, CMM, MSC, CD, Deputy Minister

- Ministerial portfolio:

- Veterans Affairs

- Enabling instruments:

- Year of incorporation / Commencement:

- 1923

Our raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on our website.

For more information on our organizational mandate letter commitments, see the “Minister’s mandate letter”.

Veterans Ombudsman’s mandate

The mandate for the OVO is available on the Ombudsman’s website.

Operating context and risk

Information on the operating context and key risks is available on our website.

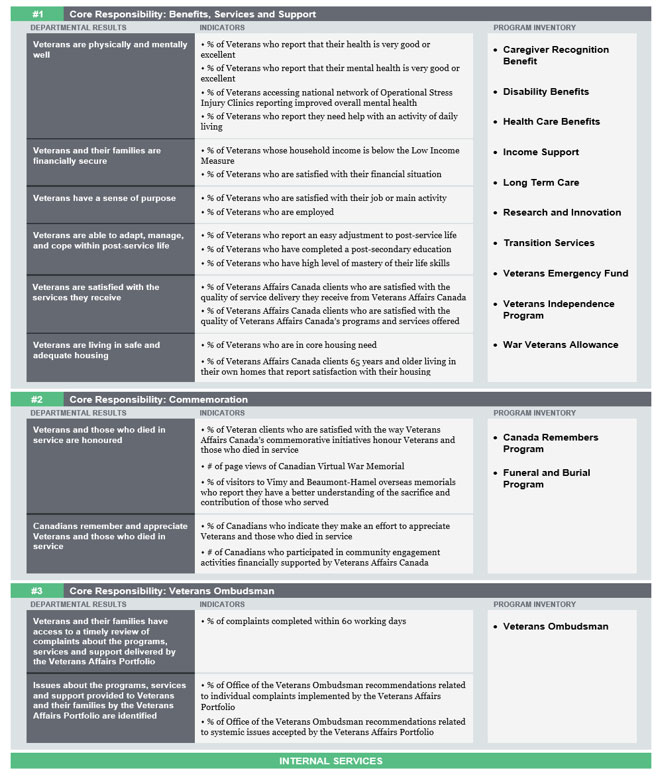

Reporting framework

Our approved DRF and PI of record for 2021–22:

Core Responsibility 1: Benefits, Services and Support

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans are physically and mentally well |

|

|

| Veterans and their families are financially secure |

|

|

| Veterans have a sense of purpose |

|

|

| Veterans are able to adapt, manage, and cope within post-service life |

|

|

| Veterans are satisfied with the services they receive |

|

|

| Veterans are living in safe and adequate housing |

|

Core Responsibility 2: Commemoration

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans and those who died in service are honoured |

|

|

| Canadians remember and appreciate Veterans and those who died in service |

|

Core Responsibility 3: Veterans Ombudsman

| Departmental Results | Indicators | Program Inventory |

|---|---|---|

| Veterans and their families have access to a timely review of complaints about the programs, services and support delivered by the Veterans Affairs Portfolio |

|

|

| Issues about the programs, services and support provided to Veterans and their families by the Veterans Affairs Portfolio are identified for resolution. |

|

Internal Services

| Structure | 2021–22 | 2020–21 | Change | Reason for change |

|---|---|---|---|---|

| Core Responsibility | Benefits, Services and Support | Benefits, Services and Support | No change | — |

| Program | Caregiver Recognition Benefit | Caregiver Recognition Benefit | No change | — |

| Program | Disability Benefits | Disability Benefits | No change | — |

| Program | Health Care Benefits | Health Care Benefits | No change | — |

| Program | Income Support | Income Support | No change | — |

| Program | Long Term Care | Long Term Care | No change | — |

| Program | Research and Innovation | Research and Innovation | No change | — |

| Program | Transition Services | Transition Services | No change | — |

| Program | Veterans Emergency Fund | Veterans Emergency Fund | No change | — |

| Program | Veterans Independence Program | Veterans Independence Program | No change | — |

| Program | War Veterans Allowance | War Veterans Allowance | No change | — |

| Core Responsibility | Commemoration | Commemoration | No change | — |

| Program | Canada Remembers Program | Canada Remembers Program | No change | — |

| Program | Funeral and Burial Program | Funeral and Burial Program | No change | — |

| Core Responsibility | Veterans Ombudsman | Veterans Ombudsman | No change | — |

| Program | Veterans Ombudsman | Veterans Ombudsman | No change | — |

Supporting information on the Program Inventory

Supporting information on planned expenditures, human resources, and results related to our Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on our website.

- Departmental Sustainable Development Strategy

- Details on transfer payment programs

- Gender-based analysis plus

- United Nations 2030 Agenda and the Sustainable Development Goals.

Federal tax expenditures

Tax expenditures are the responsibility of the Minister of Finance, and the Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis. The tax measures presented in this report are solely the responsibility of the Minister of Finance.

Organizational Contact information

Veterans Affairs Canada

161 Grafton Street

P.O. Box 7700

Charlottetown, PE

C1A 8M9

Toll free: 1-866-522-2122

Veterans Affairs Canada website

Veterans Ombudsman

134 Kent Street

P.O. Box 66

Charlottetown, PE

C1A 7K2

Toll free: 1-877-330-4343

Veterans Ombudsman website